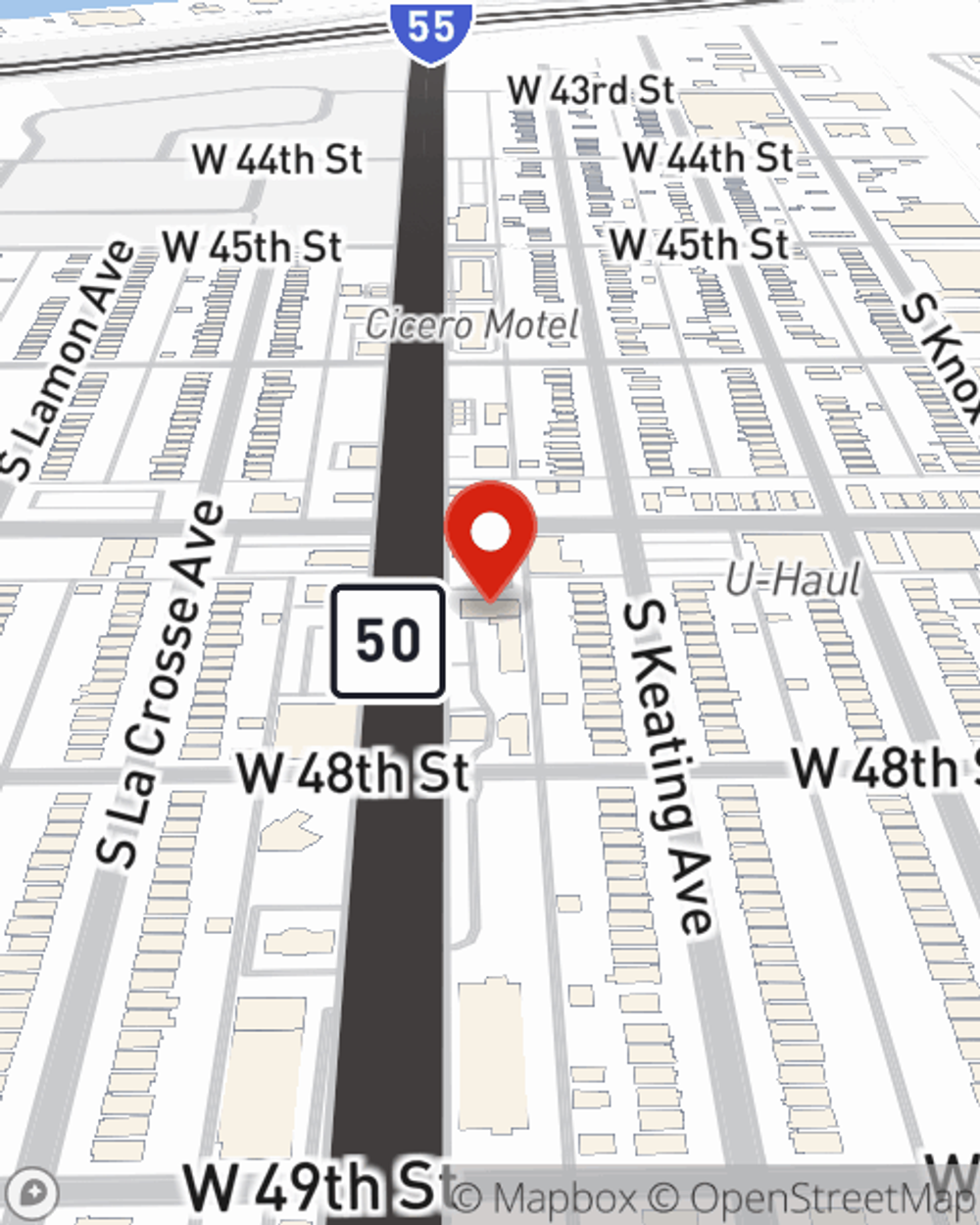

Renters Insurance in and around Chicago

Looking for renters insurance in Chicago?

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Chicago, IL

- Cook County, IL

- Archer Heights, IL

- West Lawn, IL

- Bedford Park, IL

Home Is Where Your Heart Is

Trying to sift through deductibles and savings options on top of keeping up with friends, your pickleball league and work, is a lot to think about and remember. But your belongings in your rented condo may need the remarkable coverage that State Farm provides. So when mishaps occur, your tools, swing sets and sound equipment have protection.

Looking for renters insurance in Chicago?

Renting a home? Insure what you own.

Why Renters In Chicago Choose State Farm

Renters insurance may seem like the last thing on your mind, and you're wondering if it's really necessary. But pause for a minute to think about how much it would cost to replace all the valuables in your rented apartment. State Farm's Renters insurance can help when abrupt water damage from a ruptured pipe damage your belongings.

If you're looking for a committed provider that can help you understand your options, get in touch with State Farm agent Josh Santos today.

Have More Questions About Renters Insurance?

Call Josh at (773) 767-0440 or visit our FAQ page.

Simple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Josh Santos

State Farm® Insurance AgentSimple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.